Content

- We can guide your business to financial profitability and safety so you can achieve your goals.

- We Partner with Your In-House Team

- Department of Business

- Future Focused Accounting Services

- Case Study – A Media-Buying Agency Reaps the Benefits of Having a Team of Financial Experts

- State Board Requirements

- Business Sales

- Business Information Worker: Technical Skills Schedule

As a professional working as a CPA or accountant, tax procedure is something that you will encounter frequently in your field. If you are the site owner (or you manage this site), please whitelist your IP or if you think this block is an error please open a support ticket and make sure to include the block details (displayed in the box below), so we can assist you in troubleshooting the issue. We create partnerships with the companies we work with to elevate their financial understanding. This is a top of the market product and a leader in secure data. Or, if you have any questions about the program, contact us via the Request Info button. As a CalCPA 100% Membership School, our full-time and part-time students who have never been a licensed CPA, nor achieved a bachelor’s degree are eligible to apply for free student membership.

Our human resources department can keep your business legally compliant while working with you to administer a variety of programs beneficial to not only you as the employer but to your valued employees. We add value to your business by working with you throughout the year, not just during tax season. Outsourced, automated, and cloud-based accounting improves your cash flow, profitability, and tax preparedness. Experienced advisors help you make the right decisions to grow your business.

We can guide your business to financial profitability and safety so you can achieve your goals.

We partner with your business as either your full accounting team or an extension of your current department so you can focus on future growth. At FLORES we embrace a model of leadership and management that empowers every team member, at every level, to provide our clients with the highest level of service. We are deeply dedicated to our client’s success and our goal is to be “Your Partner for Success”. We believe in driving businesses forward, allowing our clients to grow and positively influence their communities. Our team and methodology create these opportunities for our clients. Our online platforms ensure you have full access to the health of your business at all times.

Is SDSU a good accounting school?

Our faculty enjoys a national reputation for its innovations in accounting education and its contribution to the body of knowledge in accounting, auditing, and taxation.

The program guides students through the preparation, use, and applications of customer relationship management (CRM) systems. The program also includes instruction in sales communication skills, organizational skills, confidence building, and professional resiliency. Students who successfully complete the program can use the knowledge, skills, and tools learned to obtain a job in a sales profession, manage the sales for a small business, Bookkeeping Services in San Diego or effectively sell their own products or services as an entrepreneur. Based in San Diego since 2003, Paragon Accountants is an accountant and advisory firm that specializes in planning, bookkeeping, tax, and accounting services. The firm is accredited by the Better Business Bureau, is a QuickBooks Intuit Certified ProAdvisor, and is a member of the National Association of Tax Professionals and the California Tax Education Council.

We Partner with Your In-House Team

Pat Flynn is a father, husband, and entrepreneur who lives and works in San Diego, CA. He is also an advisor to ConvertKit, LeadPages, Teachable, and other companies in the digital marketing arena. Having a dedicated four-person accounting team outside of your business reduces your risk of fraud, and increases accountability, by incorporating proper internal controls. Our Founder & CEO, Matt Garrett started and sold several companies before founding TGG. He created the TGG Way™ which provides companies with the insights and experience from those ventures, giving them the financial clarity they need to succeed.

Specializing in small business accounting, Profitwise Accounting is a San Diego-based firm founded in 2004. The firm is a member of the Professional Association of Small Business Accountants. Coastal Tax Advisors is a tax planning-focused CPA firm for individuals and businesses in San Diego and nearby areas.

Department of Business

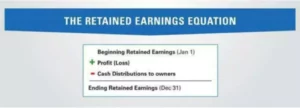

Growing with the increased complexity of the business world, accounting continues to offer a wide choice of careers and opportunities. Our programs are designed to be working-student friendly and most of our students are working professionals. The courses vary between two and three units, which amount to approximately hours of class time for a two unit course and hours of class time for a three unit course. This course covers recording, valuation, and presentation of investments, leases, pensions, corporate income taxes, paid-in capital and retained earnings.

- TGG’s GAAP compliant reporting gives buyers confidence in the value of your business.

- We add value to your business by working with you throughout the year, not just during tax season.

- Explore traditional costing theories and procedures (developing standards, computing variances, determining process cost…

- The team at FLORES Services is here to provide you with a quality back office ensuring that all of your accounting and payroll needs are not only met but also exceeded.

We are active members of more than 17 regional trade association memberships, allowing us to contribute to the growth of business and industry in the region through board memberships, event sponsorships, and program development. Through our office donation-matching program we give back to the community, matching individual contributions to support our personnel’s philanthropic passion in San Diego. Our strong volunteer committee organizes events with an impact throughout the year for our professionals, their families, and their friends to support. Build a more profitable company with remote bookkeeping, taxation, payroll, and CFO-level services from Profitwise Accounting.

Future Focused Accounting Services

Melike Bell moved to the United States from Istanbul, Turkey with her sister, Mehtap Safi, to open a home good store. Bell, a former Bank Manager, dreamed of importing luxurious home goods from Istanbul to San Diego. I wanted to start something new in a new country.” Bell enrolled in San Diego College of Continuing Education’s Small Business Certificate Programs and opened her first storefront, Bell and Moon, two months later at Parkway Plaza.

All courses and certificate programs offered by UC San Diego Division of Extended Studies have been developed and are administered in accordance with Extension policy and the regulations of the Academic Senate of the University of California. The critical role of accounting and finance requires technical competencies used in decision support for all areas of healthcare management. Are you an entry-level auditor, accounting student or professional who needs to learn or review auditing objectives and techniques? This course will teach you about internal control processes and proc…

Case Study – A Media-Buying Agency Reaps the Benefits of Having a Team of Financial Experts

Each student has their own learning style so this can vary greatly. As a rule of thumb, expect to spend an average of two hours studying for every hour you spend in-class. For online courses, https://www.bookstime.com/ students should plan to spend approximately 8-10 hours per week viewing lectures and completing coursework. There are nine required certificate courses which are 4.0 quarter units each.

Whether you are looking for an outsourced accounting firm to optimize an exit or seeking investor funding, a CFO’s experience and perspective create opportunities for your business to grow and prosper beyond the daily grind of keeping afloat. Gain an overview of tax and accounting methodology requirements, and strategies in relation to the development and management of rental

real estate and other real estate transactions. Financial statement analysis has many applications, including the evaluation of department and senior management performance, accounting compliance, and the profitability of business activities. We believe delivering exceptional work starts by investing in exceptional people. At Considine & Considine, our team of deeply talented tax and accounting professionals is growing rapidly. We help you improve financial performance by providing an insightful monthly financial package coupled with expert guidance on how to use that information to achieve profitable business growth, unlike any other outsourced accounting firms.

M. W. Orlando CPA, Inc. – San Diego

We work as a natural extension of your internal accounting team by providing insights, streamlined accounting processes, and collaboration with your existing staff to help you reach your goals. In a capstone written business plan project, students demonstrate a business model concept that identifies how a student may successfully grow a small business. Provides students with the basic skills necessary to achieve successful employment in the accounting field. In my working relationship with Flores Financial, I have been very impressed with the quality of their work, the professionalism they display and timeliness of the information they provide.

Is accounting still in demand?

Employment of accountants and auditors is projected to grow 6 percent from 2021 to 2031, about as fast as the average for all occupations. About 136,400 openings for accountants and auditors are projected each year, on average, over the decade.